Ze Qing’s journey as a financial consultant began during his university days, sparked by a deeply personal mission: helping his own parents assess their retirement readiness. Through this process, he discovered not only a passion for financial planning but also a glaring knowledge gap that exists in how people in his parents’ age group approach their finances.

Motivated to bridge this gap, Ze Qing has since guided hundreds toward achieving their financial aspirations. He developed a flagship asset allocation framework designed to help individuals across all age groups attain financial freedom 5–10 years earlier than they anticipated, leveraging on a strategic and professional approach to suit his clients’ needs.

In an impressive first year in the business, Ze Qing earned recognition as a member of the prestigious Million Dollar Round Table in 2024, solidifying his status as a leading figure in the financial planning industry and achieving the title of Prestige Wealth Manager.

While many utilise their achievements by posting and advertising them online, I instead view qualifications as opportunities to learn from the best advisors in the world. By studying their planning processes, I aim to bring even greater value to my clients—the very people who made this accomplishment possible for me in the first place.

As we journey through life, my knowledge and experience will grow alongside you, allowing me to deliver increasingly refined and effective planning strategies to support your goals as we journey through life together.

It all starts with proper planning. The goal isn’t to live forever, but to create something that will.

Ze Qing’s advisory services are typically catered to the mass affluent, but almost all the time, he is willing to assist and aid everyone with their financial planning. Experience next- level wealth advisory with his personalised consultation process.

To help you take ownership of your wealth and plan your financial life, setting and achieving realistic goals.

To protect what’s precious. Helping you manage your wealth, making sure all your bases are covered.

To live a financially free life, helping you make informed investment decisions, growing your wealth in a way that suits you

To ensure that you live a life that outlives you, having enough at the end of time.

To ensure that all unnecessary expenses are low, while maximising your cash flow.

To ensure that your assets are passed down to your loved ones, keeping your legacy and loved one protected.

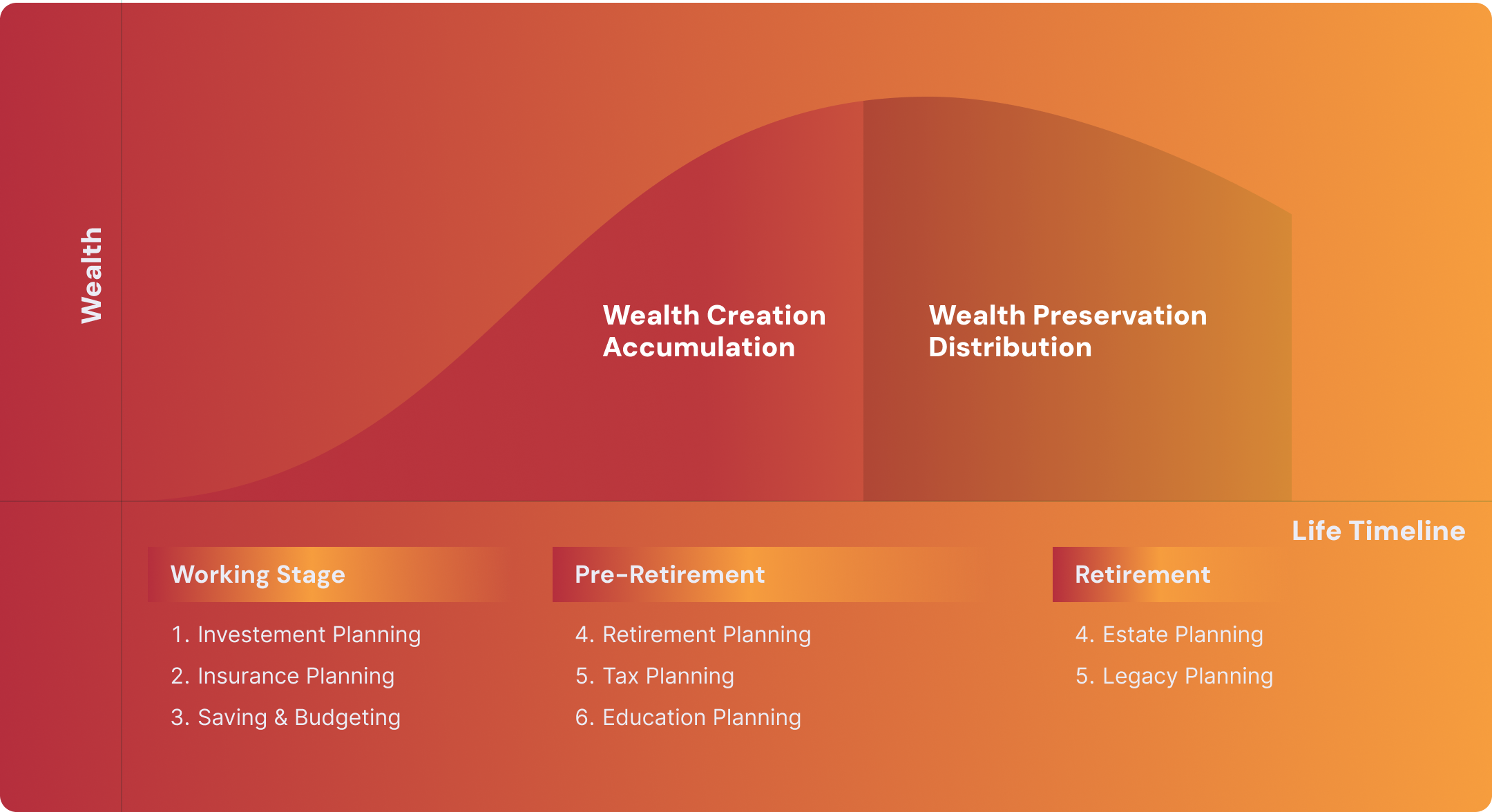

After advising hundreds of clients, Ze Qing has observed a key trend: As people progress through life, their financial needs expand while their time becomes increasingly limited.

Many struggle to properly educate themselves on wealth and financial management, leading to missed opportunities to maximize their current resources. Financial and estate planning often become a source of stress, as the focus on earning more overshadows the importance of optimising what they already have.

At some stage, people also begin to question whether they are using the right financial tools to achieve their goals, such as whether they’re overpaying for insurance or mortgage interest. These challenges are common in society, and when left unaddressed, they can escalate into larger issues like family disputes due to inadequate estate planning.

Ze Qing firmly believes that managing wealth should not only be simple but also forward-looking, ensuring that every decision sets you up for future success. His strategies have empowered clients to save $5,000–$20,000 annually on mortgage interest, significantly increase retirement income by 2–3x, and secure their financial legacy through a well-crafted estate plan. By focusing on both simplicity and foresight, Ze Qing ensure your assets are protected, efficiently distributed, and optimised for long-term growth

Ze Qing aspires to give back to his clients and community as well, organising engaging events and seminars to update clients on the changes in Singapore’s financial climate together with fun client appreciate events.

In Just 20 Minutes, Ze Qing will be able to help you unlock and identify unoptimized assets that you may have, to help you maximise your retirement income.

At the very least, you will get a better understanding of your financial position, to help you make better financial goals for your future. Treat it as a professional auditing opinion.

Authorised Representative of AIA Financial Advisers Pte Ltd (Reg. No 201715016G)

Phua Ze Qing AIA FA Financial Consultant

AWM Group

* Financial Disclaimer: It should be noted that results, earnings and income claims made are based on clients’ individual background, capacity, goals and experience. There is no assurance that examples of clients’ results can be duplicated in future. We cannot guarantee your future results and/or success.